For many employees, the rhythm of payday dictates their financial flow. Understanding the quirks of your pay schedule can make a substantial difference in your financial planning. In 2024, there are two months when those paid biweekly will enjoy three paychecks . Here’s how you can harness these extra funds to secure your financial future.

Optimizing Your Pay Structure

Employees often receive paychecks twice a month or every other week. If you’re on a biweekly schedule, you’ll see 26 paychecks a year, two more than those paid twice a month. This slight difference opens up opportunities to bolster your financial stability.

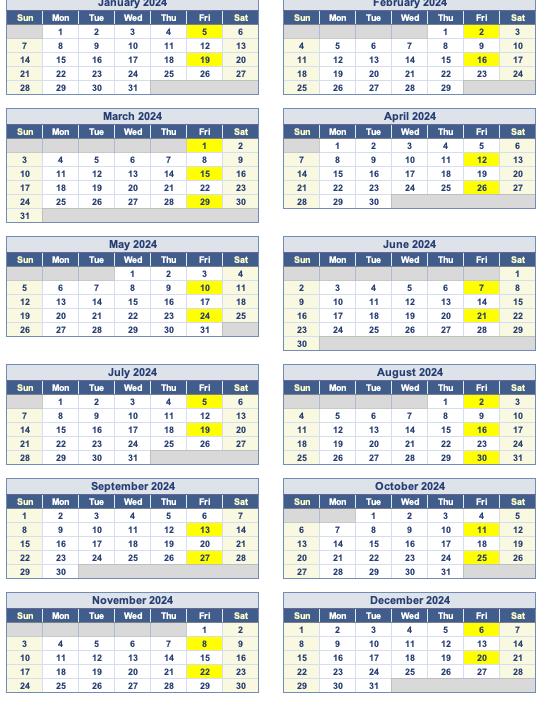

If your first paycheck in 2024 was on January 5th, you will get three paychecks in March and August 2024.

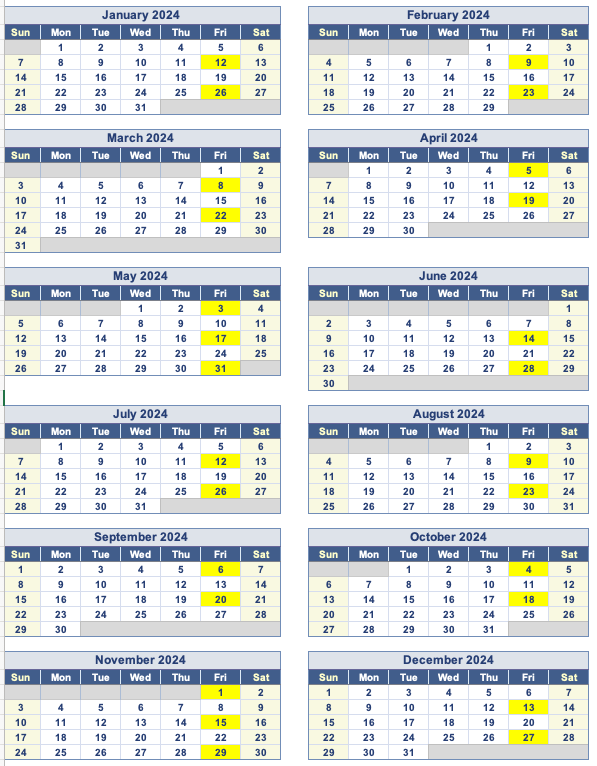

If your first paycheck in 2024 was on January 12th, you will get three paychecks in May and November 2024

Don’t Squander the Surplus

Extra paychecks shouldn’t be an excuse for splurging on frivolous expenses. Instead, approach them with intentionality. Plan your budget around receiving two paychecks per month, allowing the extra paychecks to serve as strategic financial tools.

Utilize the additional income for:

- Building an Emergency Fund: Start or strengthen your emergency fund, ensuring you’re prepared for unexpected financial challenges. Aim for at least six months’ worth of expenses saved in a readily accessible account.

- Tackling High-Interest Debt: Redirect surplus funds towards paying off high-interest debts, beginning with the loans carrying the highest interest rates. This approach minimizes interest payments and accelerates your journey to financial freedom.

- Investing in Retirement: Boost your retirement savings by contributing to IRAs or Roth accounts. Even modest monthly contributions can yield significant returns over time, thanks to the power of compounding.

- Exploring Discretionary Investments: Consider allocating funds to a discretionary investment account, where you can explore opportunities in index funds, individual stocks, or dividend-paying assets. Diversifying your investment portfolio can provide additional sources of passive income.

- Accelerating Mortgage Payments: Reduce the principal balance of your mortgage by making additional payments, potentially shortening the loan term and saving on interest expenses in the long run.

- Saving for Major Expenses: Whether it’s a down payment on a home, holiday gifts, or home improvement projects, earmark funds from extra paychecks to achieve your financial goals faster.

- Investing in Education: Start saving for your children’s college education by contributing to a 529 plan. Early contributions can ease the burden of future tuition costs.

Crafting Your Financial Strategy

By proactively planning for three-paycheck months, you can lay the groundwork for a more secure financial future. Whether you’re focused on debt reduction, savings accumulation, or investment growth, these additional paydays offer valuable opportunities for financial empowerment. Take control of your finances today to realize your long-term goals tomorrow.