Only 40% of Americans are able to cover an unexpected expense of $1000 according to a Bankrate poll. When an unexpected expense occurs, a majority of Americans put it on a credit card or apply for a loan.

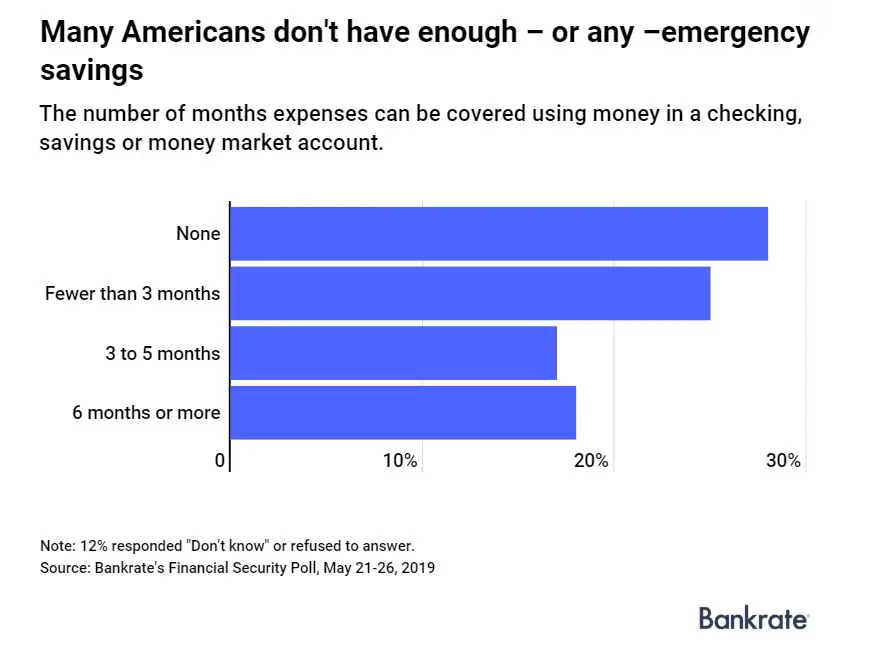

Nearly three in 10 Americans have no emergency fund. For even those who have an emergency fund, the situation is not rosy. Most do not enough money to cover three months’ worth of living expenses.

What can you do to be better prepared? Here are some tips.

1. Have A Plan

This may sound very basic. You will be surprised how many smart people don’t have any idea how much money comes in, and how much goes out every month. If you don’t have a good understanding of your financial condition, it is very hard to put the other financial pieces in place.

Make a list of all your income and all your expenses. Include annual or semiannual expenses such as insurance, gifts, etc. First, do you make enough to meet all your expenses? Hopefully, you do and you have some money left over. If not, come up with a budget you can stick to.

2. Track Your Expenses

It’s easy to spend money mindlessly by eating out every day or forget that you have some subscriptions on auto-renew. Track your expenses closely. Know where your money is going.

I take a look at my expenses when I pay my credit card bill at the end of the month. Sometimes, it’s eye-opening to see I am spending the money. I make minor adjustments to my spending when I see that I am off track. If you don’t catch your excessive spending habits early, it becomes very difficult to make changes because big changes are painful.

I also like to plan my expenses. Whether it is a grocery trip or a week-long vacation, I like to plan ahead. This ensures that there are no surprises and I don’t end up spending money on things I hadn’t planned.

Review expenses periodically, especially recurring expenses. Do you need to subscribe to a magazine you haven’t read in months? Do you still need a cable TV subscription? Be ruthless in cutting spending where possible.

3. Save Money First

Set up an automatic transfer from your checking account to an investment or saving account every month. That way, you save first before you spend any money. It comes right off the top, and you won’t even see it. I do this for not only my 401(k) but also my discretionary investing account.

Save at least 10% of your earnings, and invest it. Max out your 401(k) if you can. At a minimum, contribute enough to get your employer’s match.

4. Avoid Consumer Debt

Don’t carry debt except for your mortgage. Especially stay away from credit card debt. Most credit cards charge interest rates north of 10%, and once you get into debt, it’s tough to get out.

Apart from the mortgage on my house, I don’t like to carry any debt. I prefer to pay cash for everything else. I save money to buy a car and then pay cash. I don’t want to make monthly payments for 7 years while my car is depreciating.

5. Set Up Emergency Fund

Have an emergency fund with at least 6 months of expenses. Unexpected things happen in life. An illness, loss of a job, or roof leak in your house. An emergency fund will allow you to handle these life disruptions without too much stress.

Ensure that your emergency fund is liquid, so you can tap it when you need it.

6. Don’t Try To Keep Up with The Kardashians

Peer pressure is real. If your friends are buying a brand new luxury vehicle every 5 years, you would want to do it too. Resist the temptation to keep up with them. Have a financial plan and stick to it. The rewards will be worth it. Your friends are probably one or two payments away from losing their car or their house.

As your income grows, in most cases so does your lifestyle. If you can keep your expenses flat as your income grows, you are on your way to financial independence.

7. Increase Your Income

Most financial advice is focused on avoiding expenses. Very few people talk about increasing income. Apply for a new job every so often, and see if you can earn more. Learn a new skill that will make you more valuable. Get a side hustle. Your side hustle may one day become your primary source of income.

8. Be Sensible – Don’t Be Too Frugal

It’s nice to be financially independent, and not have to worry about regular monthly expenses. But don’t be so frugal that you are not having any fun at all. The goal is not to maximize your wealth at the cost of your happiness. Be sensible and spend money where it’s appropriate. Always have a plan, and stick to it.