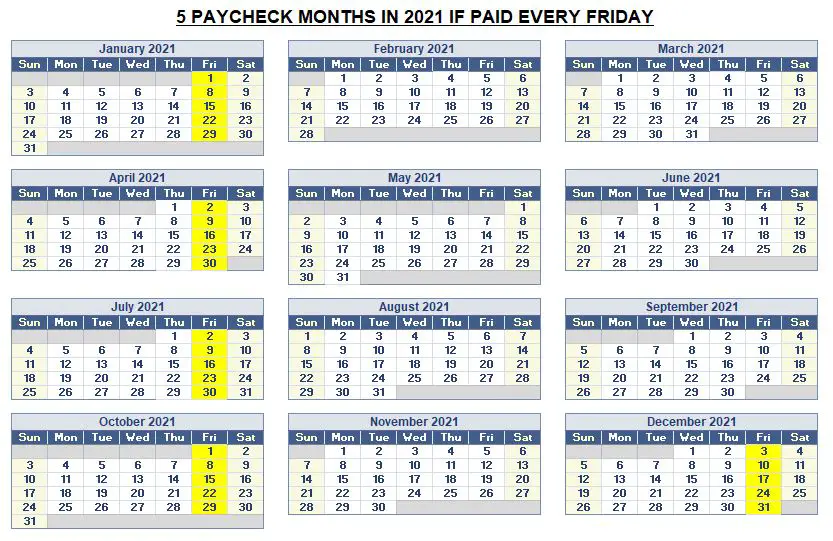

If you get paid on Fridays every week, there are five months in 2021 when you will get five paychecks. Five paycheck months in 2021 are January, April, July, October, and December.

Note that January 1, 2021, is a holiday and you may be getting that paycheck on Dec 31, 2020.

The best way to put the extra money to use is to make your monthly budget based on four weekly paychecks rather than five. You can use the paycheck to start an emergency fund if you don’t have one, reduce your debt, or save money for a home improvement project.

Take advantage of your 5 paycheck months

Have a plan to put the extra paycheck to work

Lack of planning is the main reason people blow their extra paycheck. Some people don’t even know what months these extra paychecks come in. Have a plan to put the extra dollars to work.

Start an emergency fund – Start an emergency fund if you don’t have one. Experts recommend having six months of expenses saved in liquid accounts such as a savings account or a money market account for emergencies such as an illness or unexpected job loss.

Pay off your high-interest debt – if you have a high-interest credit card debt or a car loan, use the money to pay some of it off. If you have multiple high-interest loans, start paying off the loan with the highest interest rate, then the loan with the second-highest interest rate, and so on.

Contribute to your retirement account – if you have an IRA or a Roth account, contribute to these accounts to save for retirement. If you don’t have an IRA, it’s time to open one.

Pay off your mortgage – Consider paying off a portion of your mortgage. Check with your mortgage company to ensure that you have no prepayment penalties. If you do this, more of your future monthly payments will go towards the principal and less towards interest.

Save for downpayment on a house – If you are planning to buy a house, use the extra money to save for a downpayment on a house

Save money for Christmas gifts – Save the money in your saving account to buy Christmas gifts for friends and family at the end of the year

Save for a vacation – If you have been planning to go on a vacation, use the extra paychecks to save for the getaway trip.

Save for home improvement projects – Use the money to save for a dream home improvement project, whether it is renovating the kitchen or upgrading your media room