Most employees get paid twice a month or biweekly. If you get paid biweekly, there are two months or three months in 2021 in which you will get three paychecks depending on when you get your first paycheck.

If you get paid twice a month, you will get 24 paychecks a year – usually on the 1st and 15th of the month. But if you get paid biweekly, you will get 26 paychecks a year. That is two extra paychecks a year.

The key is to plan your monthly budget based on two paychecks rather than three. You can use the two extra paychecks to reduce your debt, save for your vacation or a home improvement project.

If you get paid on Fridays:

- If your first paycheck for 2021 is on January 1, then your three paycheck months are January, July, and December. Note that since January 1 is a bank holiday, some employers may pay early, on December 31. In that case, instead of January, you will get the extra paycheck on December 31, 2020. You will get 27 paychecks in 2020 under this scenario.

- If your first paycheck for 2021 is on January 8, then your three paycheck months are April and October.

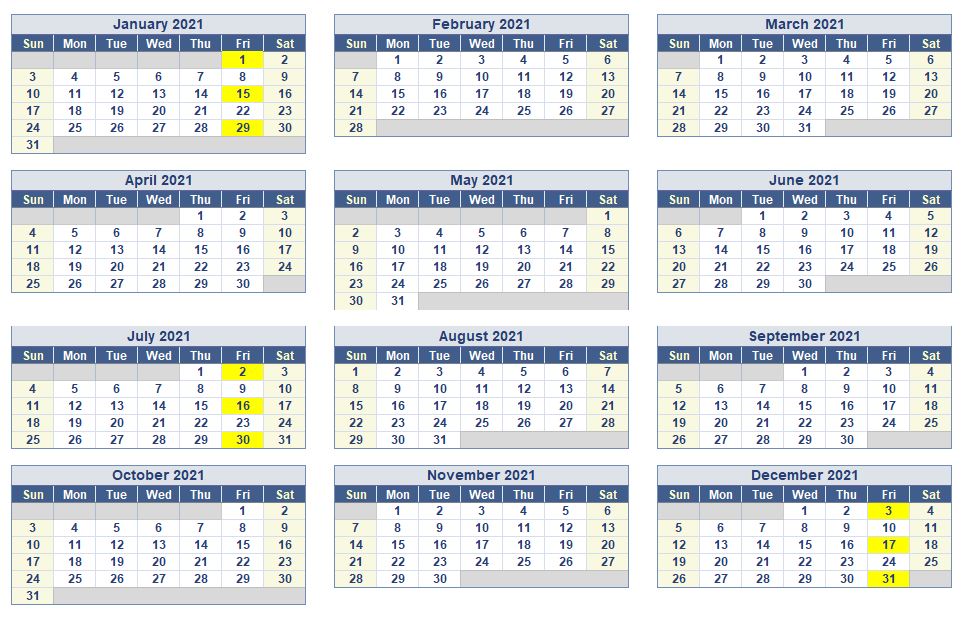

IF YOUR FIRST PAYCHECK IS JANUARY 1, 2021

If you get paid biweekly, and your first paycheck is on January 1st, your paydays are as follows. Three-paycheck months are in red.

- January 1

- January 15

- January 29

- February 12

- February 26

- March 12

- March 26

- April 9

- April 23

- May 7

- May 21

- June 4

- June 18

- July 2

- July 16

- July 30

- August 13

- August 27

- September 10

- September 24

- October 8

- October 22

- November 5

- November 19

- December 3

- December 17

- December 31

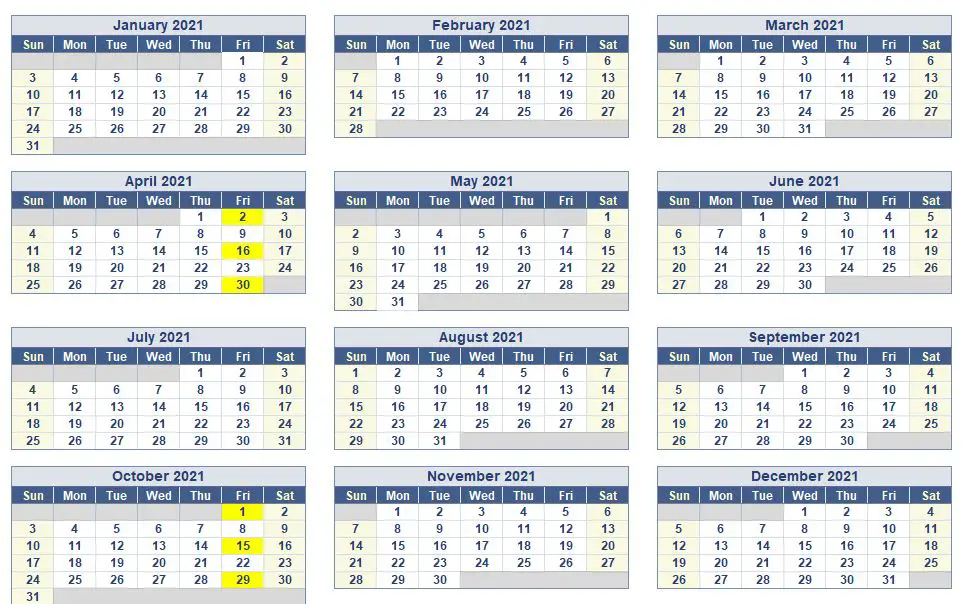

IF YOUR FIRST PAYCHECK IS JANUARY 8, 2021

If you get paid biweekly, and your first paycheck is on January 8th, your paydays are as follows. Three-paycheck months are in red.

- January 8

- January 22

- February 5

- February 19

- March 5

- March 19

- April 2

- April 16

- April 30

- May 14

- May 28

- June 11

- June 25

- July 9

- July 23

- August 6

- August 20

- September 3

- September 17

- October 1

- October 15

- October 29

- November 12

- November 26

- December 10

- December 24

How To take advantage of your 3 paycheck months

Have A Plan

If you plan, you can put the extra paychecks to work. Most people don’t have a plan and end up spending that money instead. Even worse, some people don’t even know what months those extra paychecks come in.

Build Emergency fund – If you don’t have an emergency fund, use the extra paychecks to start one. The rule of thumb is you need 6 months of expenses saved for emergencies such as an illness or unexpected job loss. Put emergency funds in a liquid account such as a money market account so that you can easily have access to the money without paying penalties.

Pay off your high-interest debt – if you have a high-interest credit card debt or a car loan, use the money to pay some of it off starting with the loan that has the highest interest rate.

Contribute to your retirement account – if you have an IRA or a Roth account, contribute to it to save for retirement. A few hundred dollars every month may not sound like much but due to the power of compounding, it will be worth a lot more in 20 or 30 years. If you don’t have one, it’s time to open one.

Pay off your mortgage – Consider paying off a portion of your mortgage. Check with your mortgage company to ensure that you have no prepayment penalties. If you do this, more of your future payments will go towards the principal and less towards interest.

Save for down payment on a house – If you don’t own a house, use the money to save for a down payment on a house

Save money for Christmas gifts – Save the money to buy Christmas gifts at the end of the year

Save for home improvement projects – Use the money to save for that dream home improvement project, whether it is renovating the kitchen or upgrading your media room.

Invest in dividend-paying stocks – If you would like to replace the income from your job with passive income, buy some good dividend stocks

Bottom line

If you get paid biweekly, you will get two to three extra paychecks a year. What months you get the extra paychecks depends on your pay calendar. Have a plan in place to put those extra paychecks to work. Contribute to your retirement account, save for a vacation or your dream home improvement project, or pay off high-interest-rate loans.