I always keep an eye on sectors that perform poorly for years. I do that by looking at how the sector performed on a 1-year, 5-year, and 10-year basis. The poorly performing sectors do eventually turn around, though it is hard to say when.

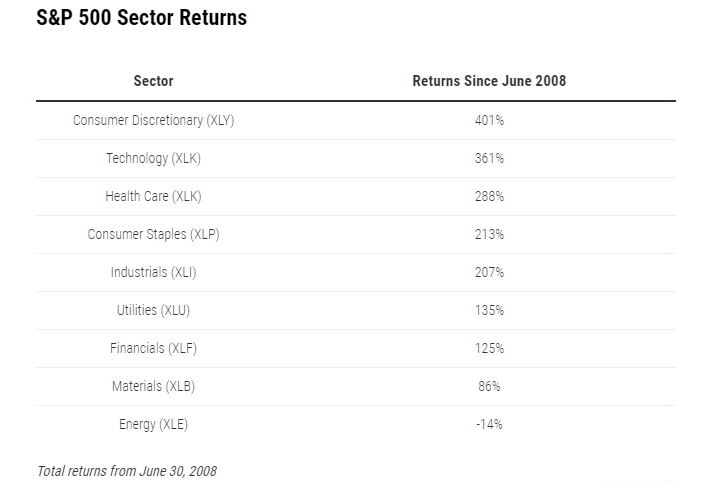

Take a look at this chart showing the S&P sector ETFs and their 10-year return.

Energy stocks have performed very poorly in the last 10 years for several reasons. They lag behind even the financials which were beaten up during the Great Recession of 2008.

Commodity Prices

The price of natural gas is slightly above $2/mmbtu, and the price of WTI is in around $50 per barrel. That’s not profitable for many drillers. With the abundance of gas, and oil production from the US, OPEC does not have the ability to impact prices like they used to, and it appears that oil and gas prices are likely to stay low for a while.

Capital Flight

The shale drillers have struggled with financial discipline. They depend on borrowing money to fund their drilling program as the cash flow from the wells are not sufficient to fund subsequent projects. They are not “self-financing”, and are heavily dependent on the capital markets. After years of losses at shale producers, lenders are tightening up their standards. As a result, the rig counts are dropping, and that’s affecting the rest of the oil industry.

Oil Field Services

Dominant oil field services companies (OFS) such as Schlumberger (SLB) and Halliburton (HAL) provide services mostly at the rig site. The dropping rig count, and immense pricing pressure form the struggling shale drillers are a double whammy for the OFS players. As a result, these companies are trading at multi-year lows.

Picking The Best of Breed

My top energy picks include Exxon (XOM) and Schlumberger (XOM). Though Exxon has struggled, it’s the bluest of blue chips in the oil industry. The company has a good mix of upstream and downstream businesses and has a yield of over 5%. Schlumberger is the best-run company in the OFS space and has a dividend yield of over 5% as well.

Both these companies are financially sound, and the dividend is not at the risk of being cut. Even if these two companies cannot cover their dividends with their cash flows, it is unlikely that they will cut their dividend because they can always borrow money to fund their dividend payouts.

Another way to play this is to own the energy ETF, XLE which has a yield of 3.7%. The top 5 holdings of this ETF are Exxon (XOM), Chevron (CVX), Phillips 66 (PSX), Conoco (COP) and Schlumberger (SLB).

Buy and Hold

The oil and gas industry is volatile, and prices fluctuate quite a bit based on OPEC statements, state of the global economy, and US tariffs. But I plan to hold SLB and XOM through the volatility for at least a few years, if not more.

The oil industry is under pressure as previously detailed, but we are nowhere near replacing fossil fuels. It’s a cyclical industry, and eventually, there will be an upturn.

Investing in beaten-down sectors is like catching a falling knife and takes a certain leap of faith. No one can catch the exact bottom of these stocks, but I do believe if you buy solid companies in the sectors at a reasonable valuation and hold them, over the long run you can make money.

Disclosure: Own XOM and SLB