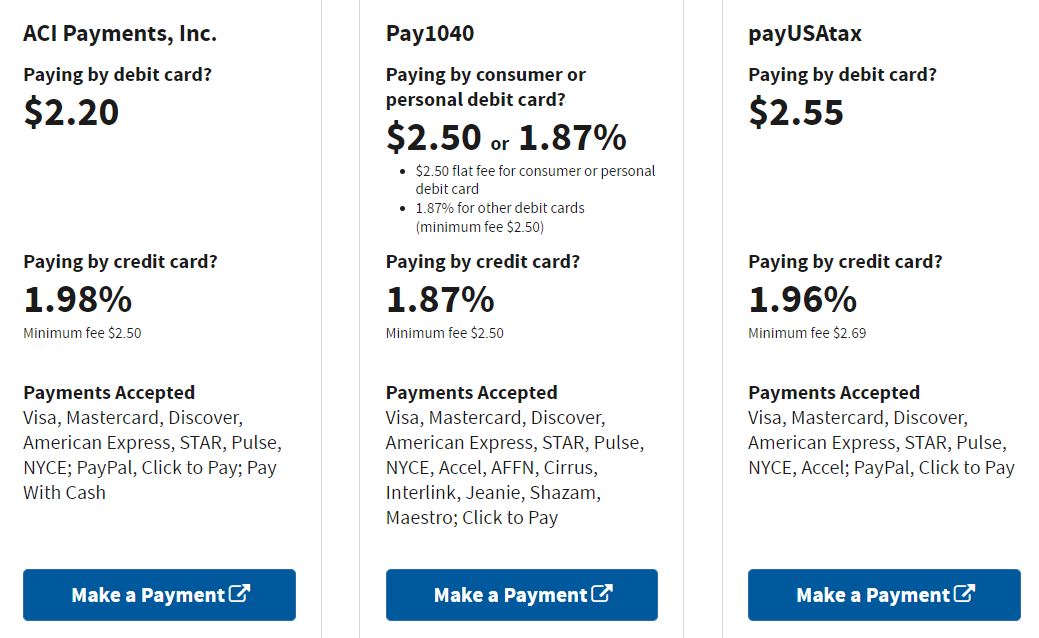

You use credit cards to make your tax payments (regular tax payments and estimated tax payments) to the IRS. IRS uses third-party processors to accept credit cards. As you can see below, you will pay about 2% in fees if you pay with a credit card.

Remember that there are no fees if you pay with a check, bank transfer, or money order. Given that, should you pay your taxes with a credit card?

Even with the 2% fees, there are several reasons why you should pay with a credit card as long as you pay your balances in full every month.

How to benefit by paying taxes with a credit card

Meet minimum spending requirements on a new card

Many credit cards require you to spend a minimum amount in the first few months to get the sign-up or welcome bonus. Paying taxes with that credit card is a good way to get those valuable miles or points.

Credit cards give you extra time to pay taxes

When you pay with a credit card you get about a month to make your payments. That can come in handy if you are managing a tight budget. Remember that credit cards have high interest rates if don’t pay the balance in full by the payment due date.

0% APR offers

If your credit card offers 0% APR for a limited time, you can buy more time. Again, remember to pay your credit card bill on time to avoid high interest rates.

Deduct credit card processing fees

If you are paying self-employment or business taxes, credit card fees can be deducted as a business expense

Downsides of paying with a credit card

Fees

If you pay taxes with a credit card, you will pay fees. There is no way to avoid that. Even if you use tax software such as H&R Block and TurboTax, you will still pay the fees. In most cases, the fees charged by these software providers will be higher than what the IRS charges.

Interest payments can be high

If you are unable to pay your credit card in full, you will incur interest payments which can nullify any points or miles you gain by paying with a credit card.

Bottom Line

Paying taxes using a credit card can be profitable in certain cases. Even after paying 2% fees, you can come out ahead if you get credit card sign-up bonuses. If you have 0% APR on your credit card, you can get several months before you must pay the full amount. Just remember to pay your credit card bills in full when it’s due.