Lessons From The The Bamboo Tree

If you plant a bamboo tree and nurture it with good soil, water and sunshine, after the first year you will see no visible growth. Nothing in the second year. Nothing in the third year or the fourth year. Then in year five, the bamboo tree grows up to 80 feet in just 6 weeks.

The bamboo tree was not just sitting there for the first four years. It was growing underground, building the foundation necessary for it to grow to its full potential. If not for the first four years, there would be no tall bamboo trees.

The 10,000 Hour Rule

To become an expert at anything, you have to spend at least 10,000 hours of practice. In his book Outliers, Malcolm Gladwell explains that all great performers had accumulated at least 10,000 hours before they became experts. Gladwell points to chess players, pianist and even the Beatles to make his case that long hours of deliberate practice is necessary to get to the top of any field.

Diminished Attention Span

An average person’s attention span today is 8 seconds. In 2000, it was twelve seconds. Between the widespread use of smartphones, and notifications from Twitter and Instagram, our ability to focus on one thing has diminished considerably. Unfortunately, this behavior has affected our investing too.

Investors Holding Periods Have Become Shorter

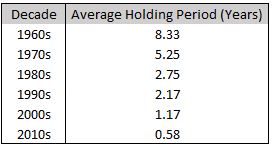

This short-term phenomenon has spread to investing as well. As you can see in the chart below, the average holding period of a stock has fallen from more than 8 years in the 1960s to around 7 months today. It’s funny to see people talking about long-term investing when they are talking about investing for about a year.

The drop in holding periods is not surprising. Electronic trading and the ability to get breaking news instantly have caused investors to trade frequently. Also not surprisingly, investors who trade frequently don’t make much money in the market.

Research shows that a stock’s total return for the year comes from gains in 10-20 days. In fact, if you miss the 10 best trading days for the stock, your return will be cut in half. Look at this chart from Fidelity.

Importance of Thinking Long Term

Building Skills Take Time

As Malcolm Gladwell notes, it takes a long time to become good at anything. That goes for investing as well. When you start to invest, you are likely to make mistakes. But over time, you will learn the various skills that go into investing – when to buy a stock, when to sell a stock, ignoring the noise, and staying focused.

By staying invested for the long term, you will undoubtedly capture the best 10-20 for the stock every year, and with the magic of compounding, your portfolio will grow.

Long-Term Investing is Boring

Your journey will be very boring but it will be worth it. Day traders and swing traders will have a lot of fun discussing the daily or weekly stock movements but your portfolio will outperform theirs. Most importantly, you will have less brain damage and will be able to focus on other things in life rather than following stock price movements on a daily basis.

Invest Consistently

The other part of the long term focus is consistency. We need to invest consistently and stay invested. If you are investing in a 401(k), invest every month. If you are investing in a discretionary account, ensure that you are putting away money periodically.

If you can set up an automatic transfer to your investing account, it works seamlessly. You may benefit from dollar-cost averaging if you buy the same stock or mutual fund over a period of time.

Sun Trust Bank’s Investment In Coca-Cola

Consider the case of Sun Trust Bank. A predecessor of Sun Trust Bank helped take Coca-Cola public in 1919. Trust Company of Georgia, Sun Trust’s predecessor bank took its underwriting fee of $110,000 (1919 dollars) in Coca Cola stock and held it for almost a hundred years. By 2007, Sun Trust was receiving 10 times its initial investment in dividends after adjusting for inflation. Imagine that!

I hear what you are saying. Sun Trust is a corporation and they can afford to hold a stock for almost 100 years. It’s a fair point. Most individuals have an investing time frame of 30-40 years. It’s possible for you and me to build that kind of wealth if we can hold a stock for 30 or 40 years. Maybe we can pass on our stock to the next generation, so they can enjoy some of the fruits of our investments.

Bottom Line

Buy companies with a proven competitive advantage at a reasonable valuation and hold it for decades. The wealth you can build with very little work will astound you.