Dividend investing is one of the best ways to generate passive income. It’s a much better stream of passive income than owning rental properties or investing in bonds. That’s because dividend investing is completely hands-off and many companies typically increase dividends over time. Unlike real estate investing, you don’t have the hassle of dealing with tenants.

When your dividend income is high enough to cover your living expenses, you have reached your dividend crossover point.

What is the dividend crossover point?

Dividend crossover point is when your dividend income exceeds your expenses. How quickly you reach your dividend crossover point depends on two factors – your expenses and your savings rate (how much you invest in dividend stocks every year).

Factors affecting dividend crossover point

Living expenses

You will reach your dividend crossover point faster if your living expenses are low. Lower expenses are easier to replace than higher expenses.

Savings rate

If your savings rate is high, and you invest in dividend stocks every year, you will be able to reach the dividend crossover point quicker.

Yield and dividend growth rate

If your dividend stocks generate high income, you can reach your dividend crossover point quickly. Higher dividend income can come from investing in stocks with high dividends or by investing in stocks that grow the dividend over time.

Dividend re-investment

If you reinvest your dividends – either in the same stock or in a different stock – you will reach your dividend crossover point quickly. Many brokerages allow you automatically reinvest dividends.

Time Horizon

Dividends grow over time. The longer your time horizon, the lower you can invest every year to meet your goals.

An example to illustrate the math behind dividend income

Let’s take a look at an example. Let’s make the following assumptions.

- Every year you invest $10,000 in dividend stocks

- The stock pays a 2% dividend every year. The company increases dividend by 7% every year

- Investment horizon is 20 years.

- Total investment during 20 years: $200,000 ($10,000 per year)

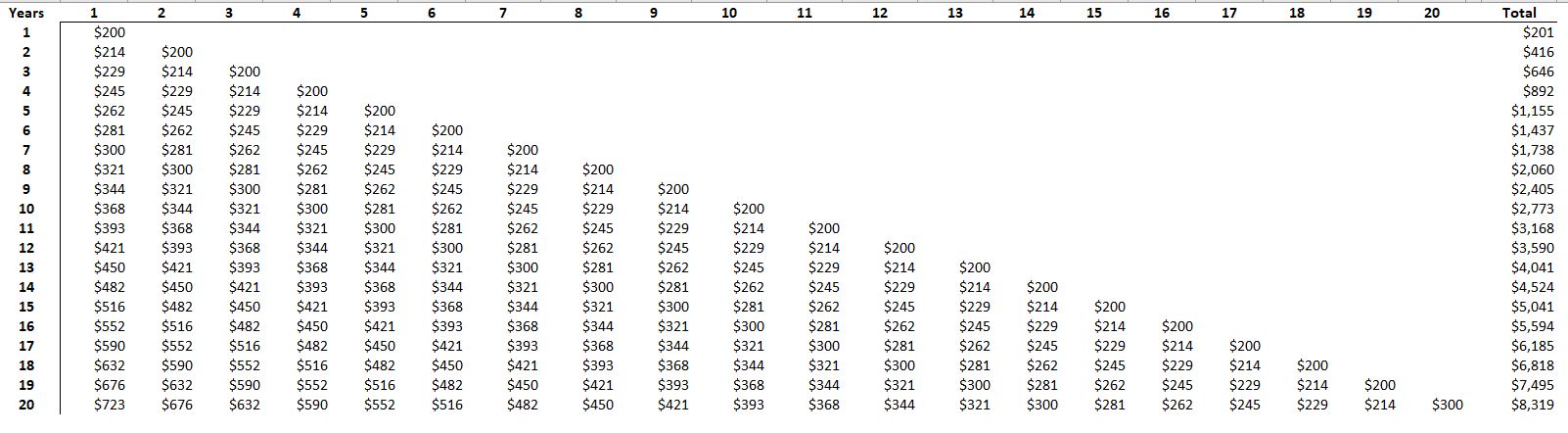

Take a look at the column for year 1. You invest $10,000 in a stock that has a 2% dividend. This investment gives you a $200 per year dividend income in the first year. In year 2, the $200 will grow to $214. In year 3, your income will be $229, etc. After 20 years, your $10,000 investment will generate $723.

If you invest 10,000 per year, you can see that your dividend income after 20 years is $8,319.

Sensitivities – Varying starting dividend and dividend growth rate

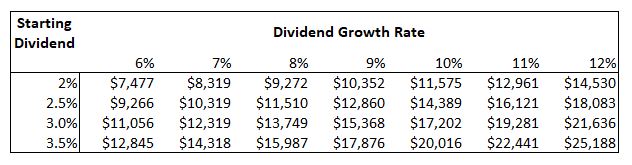

Let’s run some sensitivities. The table below shows the income after 2o years for different starting dividend rates and their growth rates. As you can see, the higher the starting dividend and the higher the growth rate, the more your income in 20 years.

The table above shows income for $10,000 annual investment for 20 years. If you can invest $20,000 every year, simply multiply the values in the table by two.

Note that the analysis above ignores tax considerations. The analysis also excludes dividend reinvestment. You should include taxes if you are investing in a taxable account. If you are investing in a Roth IRA, you don’t have to worry about taxes because withdrawals are tax-free. But Roth IRAs have a limit on how much you can contribute every year.